The Platform

Deliver a Holistic Wealth

Management Experience

Designed to deliver a better wealth management experience through better financial planning.

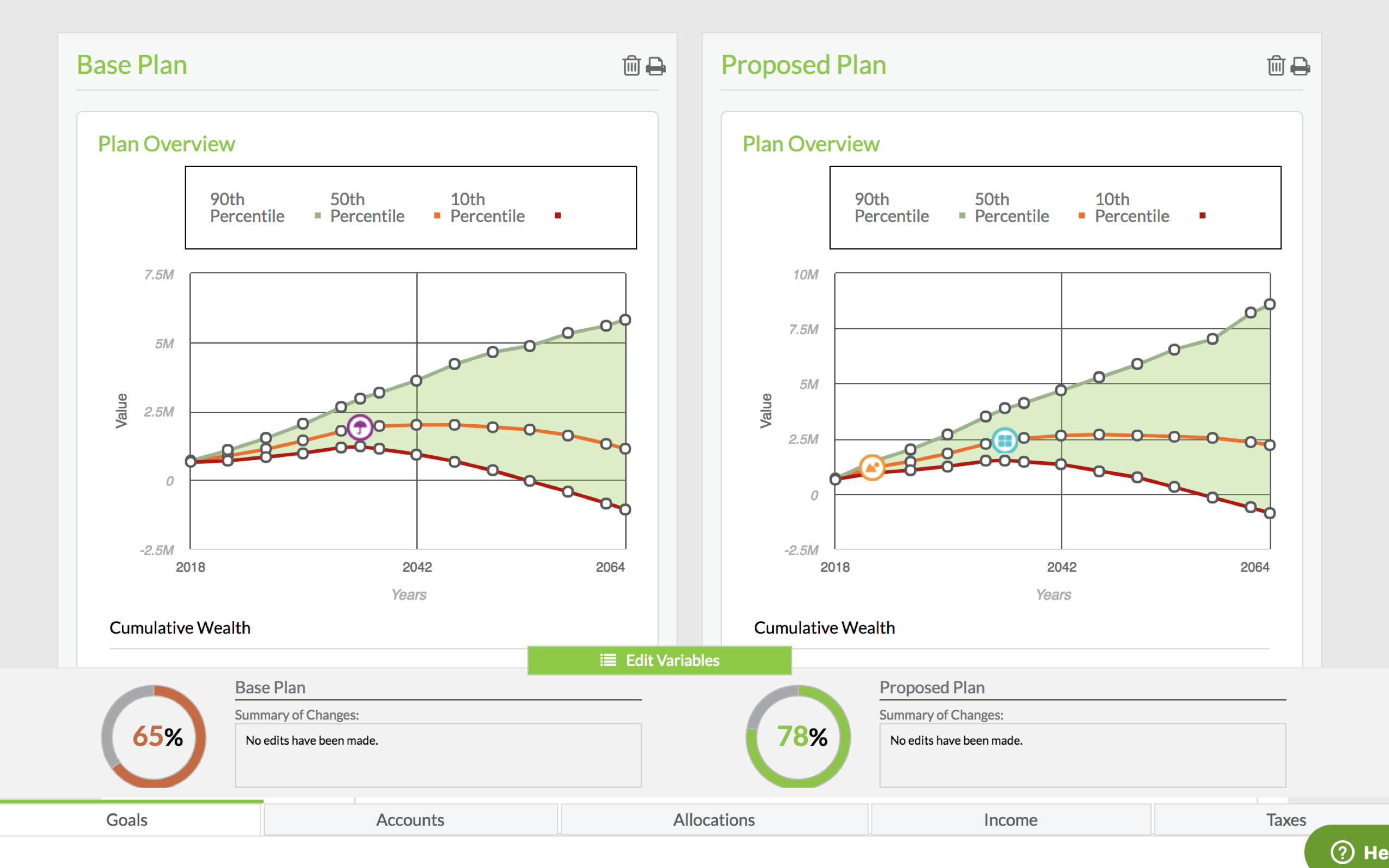

Plan Comparison

Compare multiple scenarios against each other

Plan comparison allows you to compare and view multiple plans at the same time and make the necessary adjustments on the same screen.

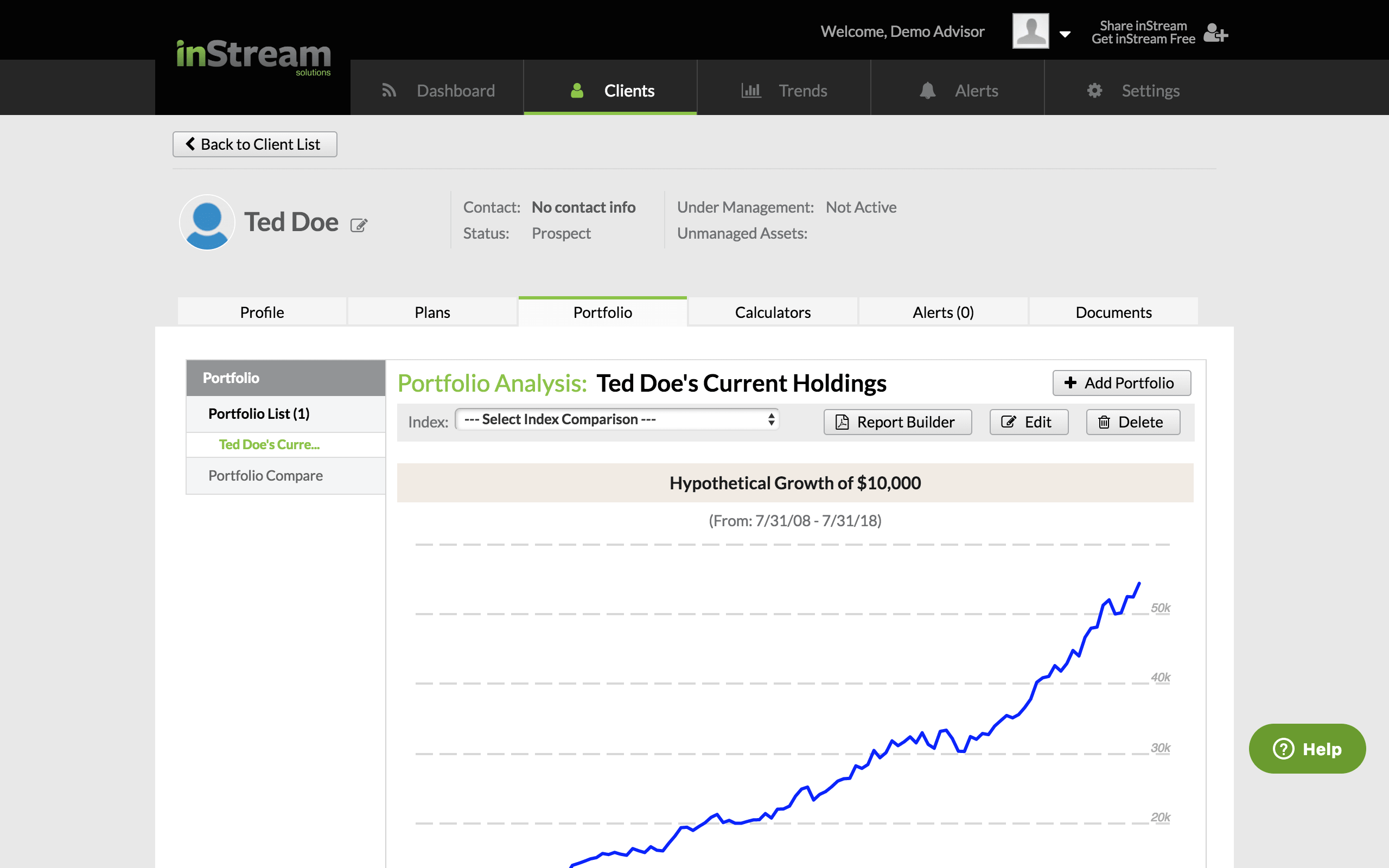

Portfolio Analysis

Automatically analyze and consolidate portfolios

Create and consolidate investment holdings, including automated analysis of held away accounts. Incorporate portfolios into your clients’ plans.

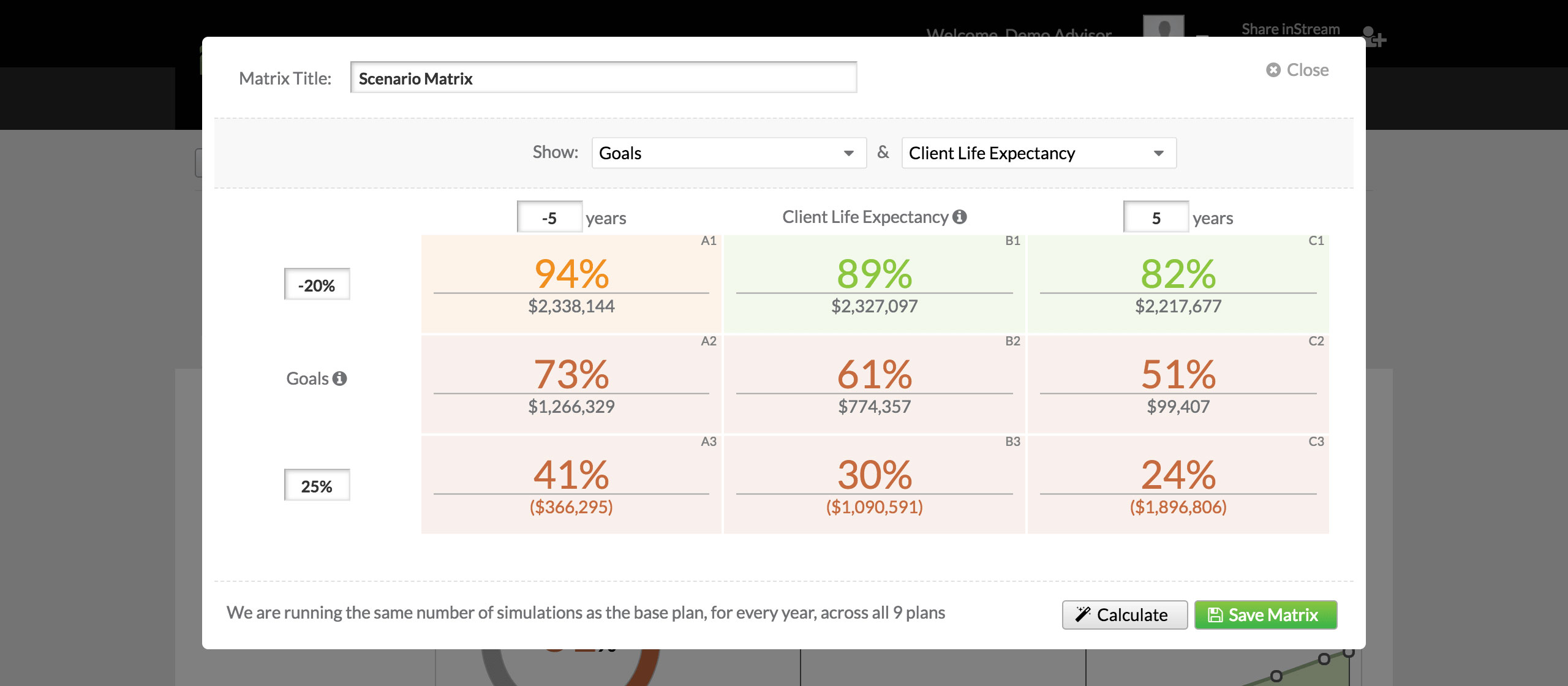

Scenario Matrix

Scenario Matrix runs nine different scenarios

Test the limits of your plan. Run nine scenarios simultaneously for insights into your client’s plan.

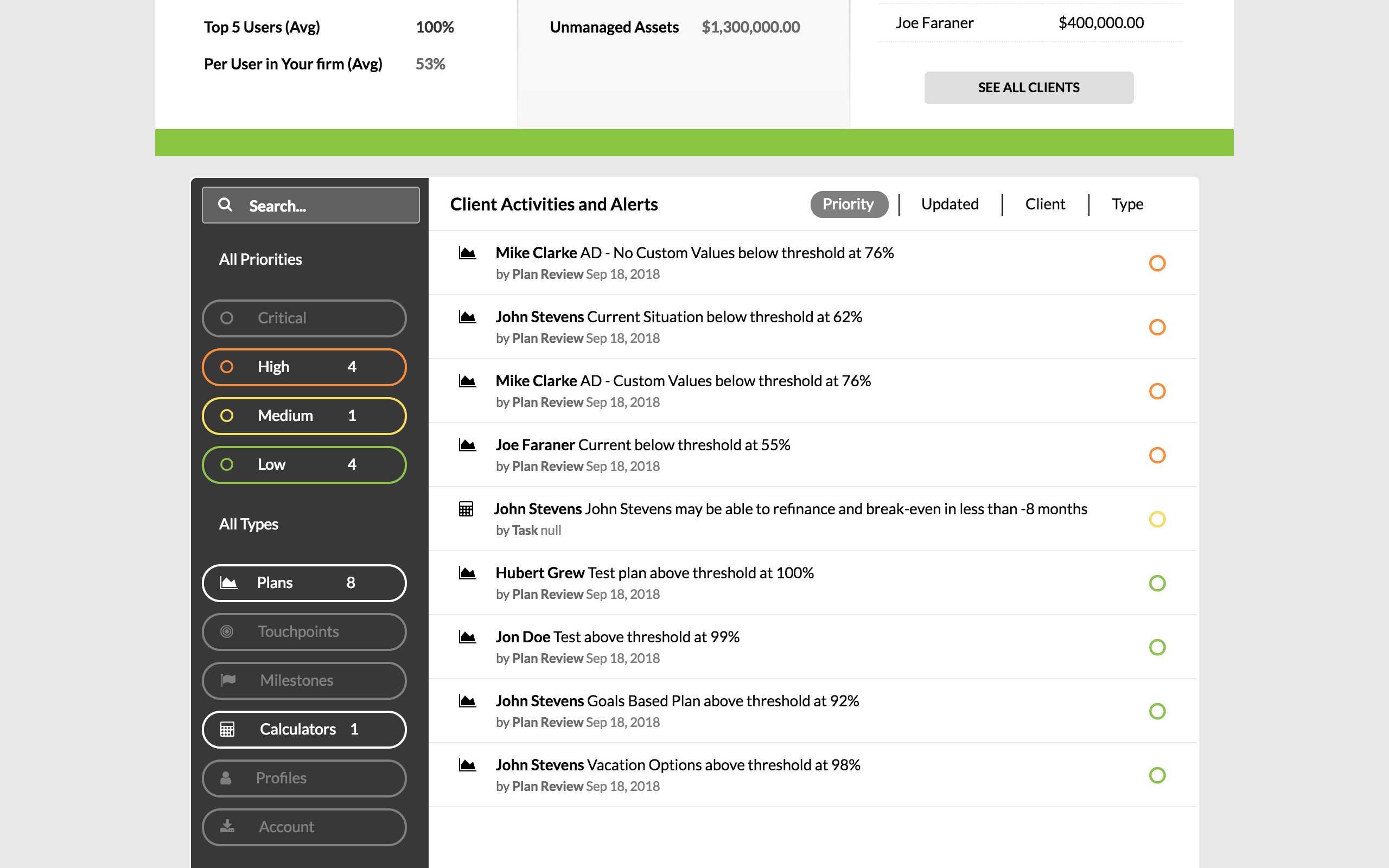

Proactive Alerts

Stay on top of client needs with proactive alerts

Monitor your alerts and build trust by proactively managing your clients’ financial plans. From automatic notifications to recurring touchpoints and planning milestones, always be a step ahead of your clients’ plans.

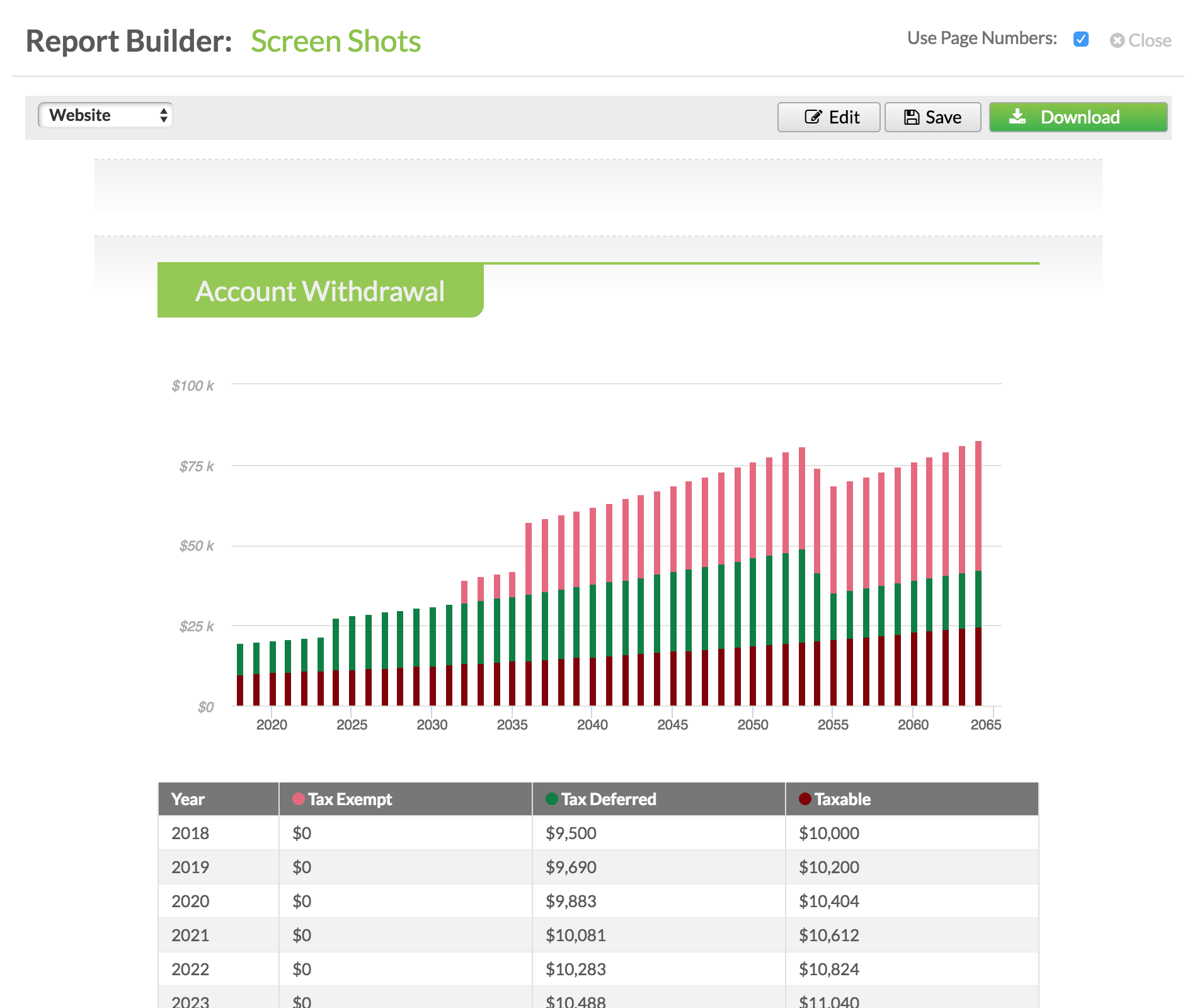

Account Withdrawals

Account Withdrawals provide flexibility you need

More planning flexibility through more control. Define exactly which account is used to fund a client’s goal.

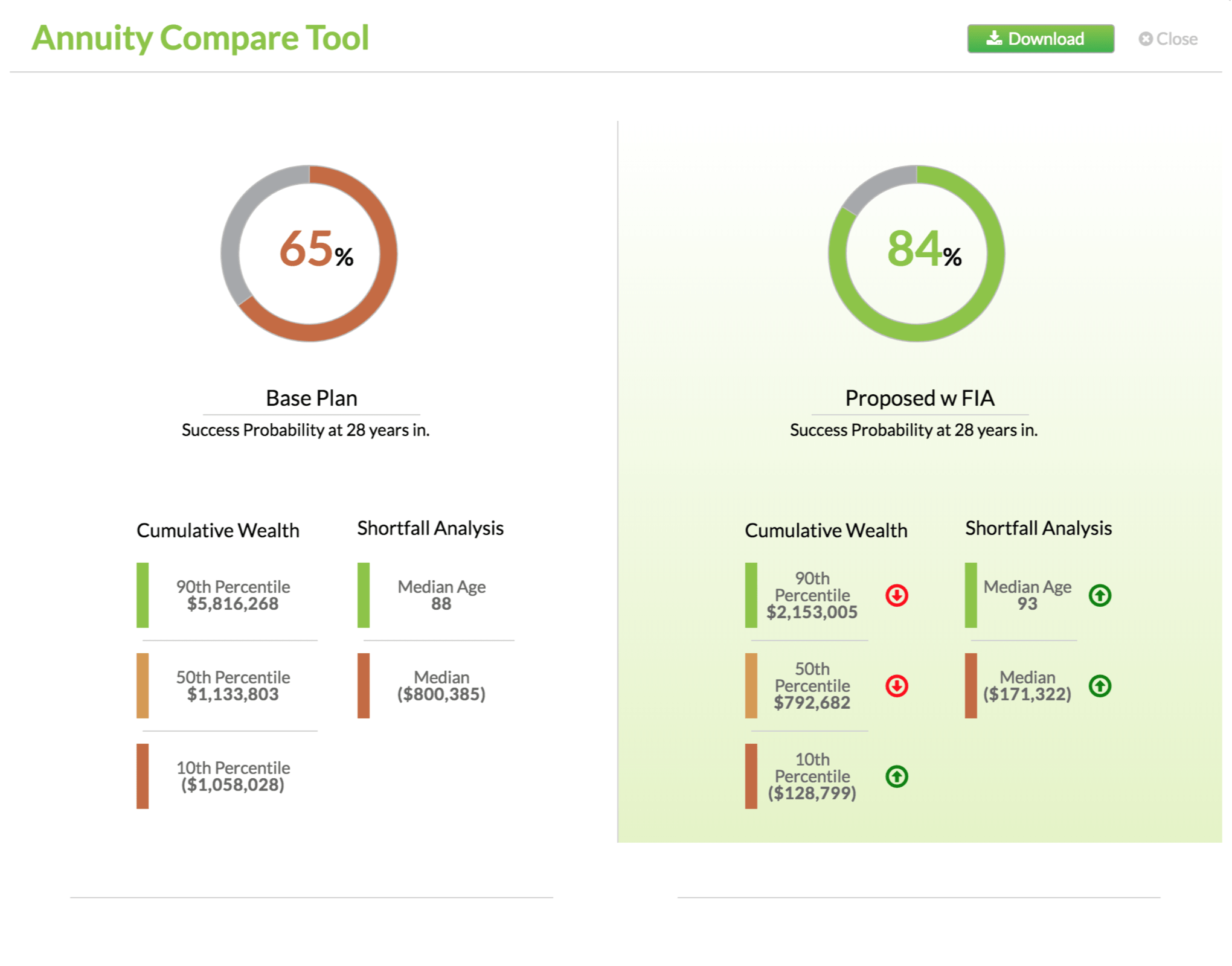

Annuities

Model expected cash flows

The Fixed Index Annuities module allows you to model the expected cash flows from different types of fixed annuities and incorporate those cash flows directly into you client's financial plan.

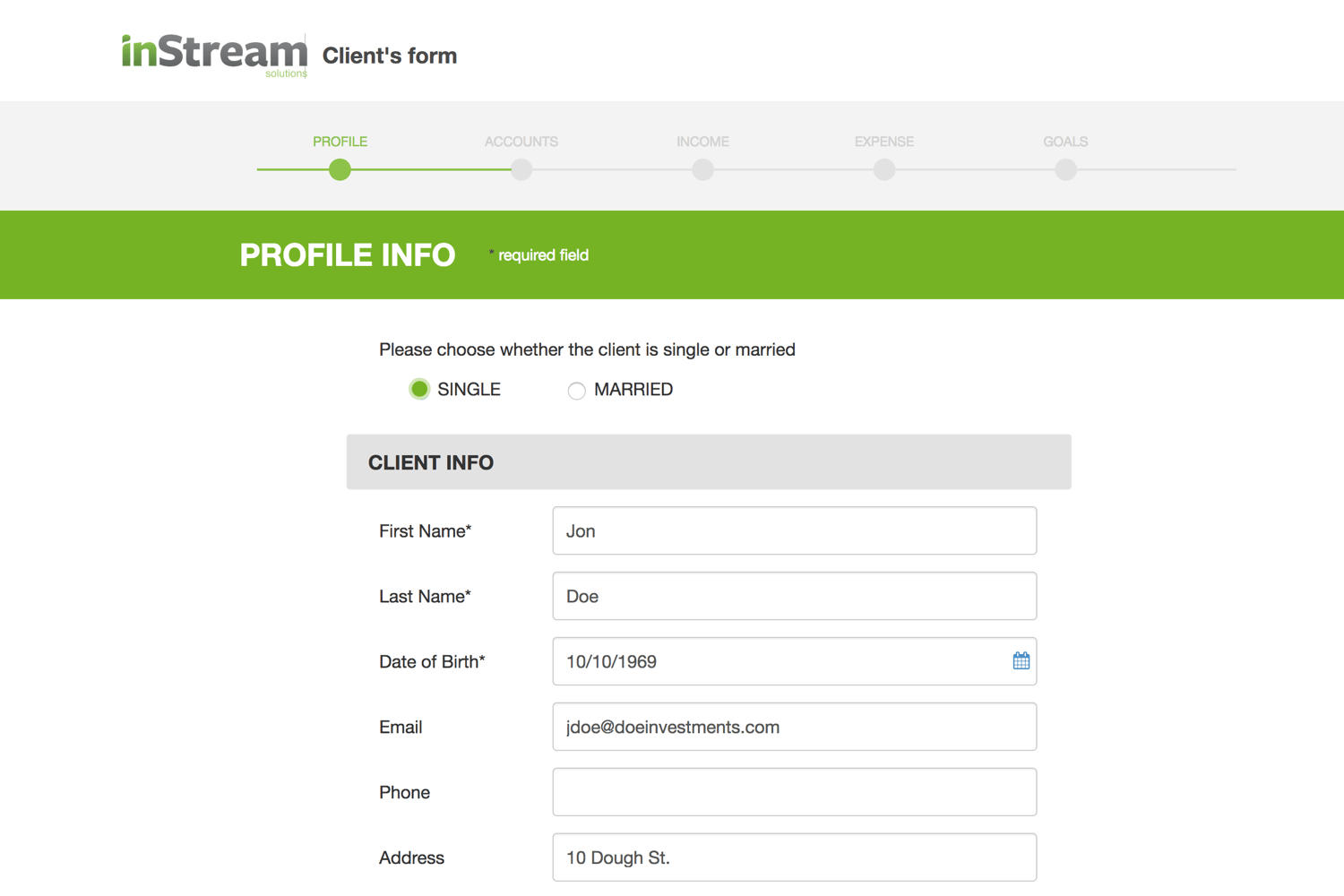

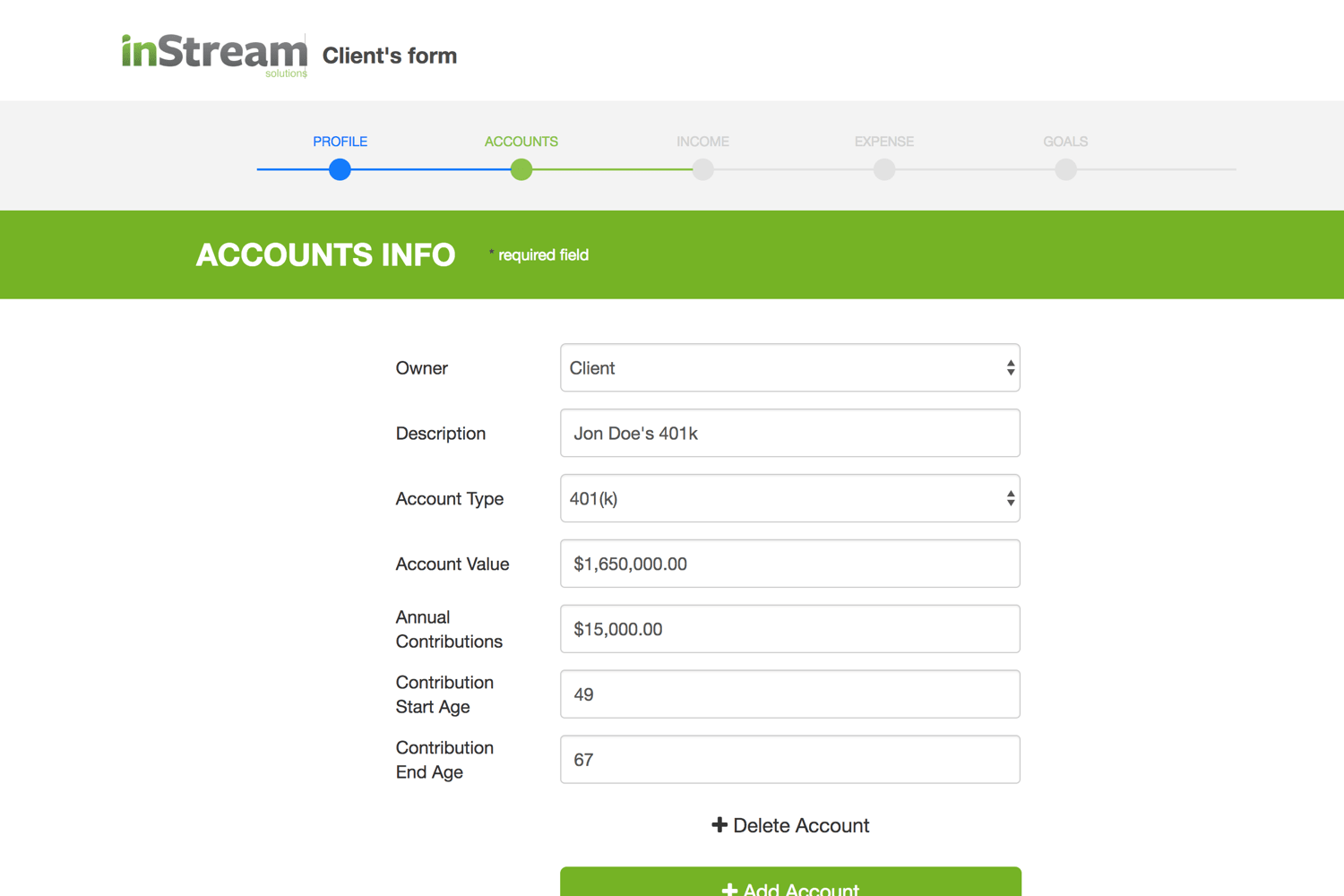

Ever-Evolving

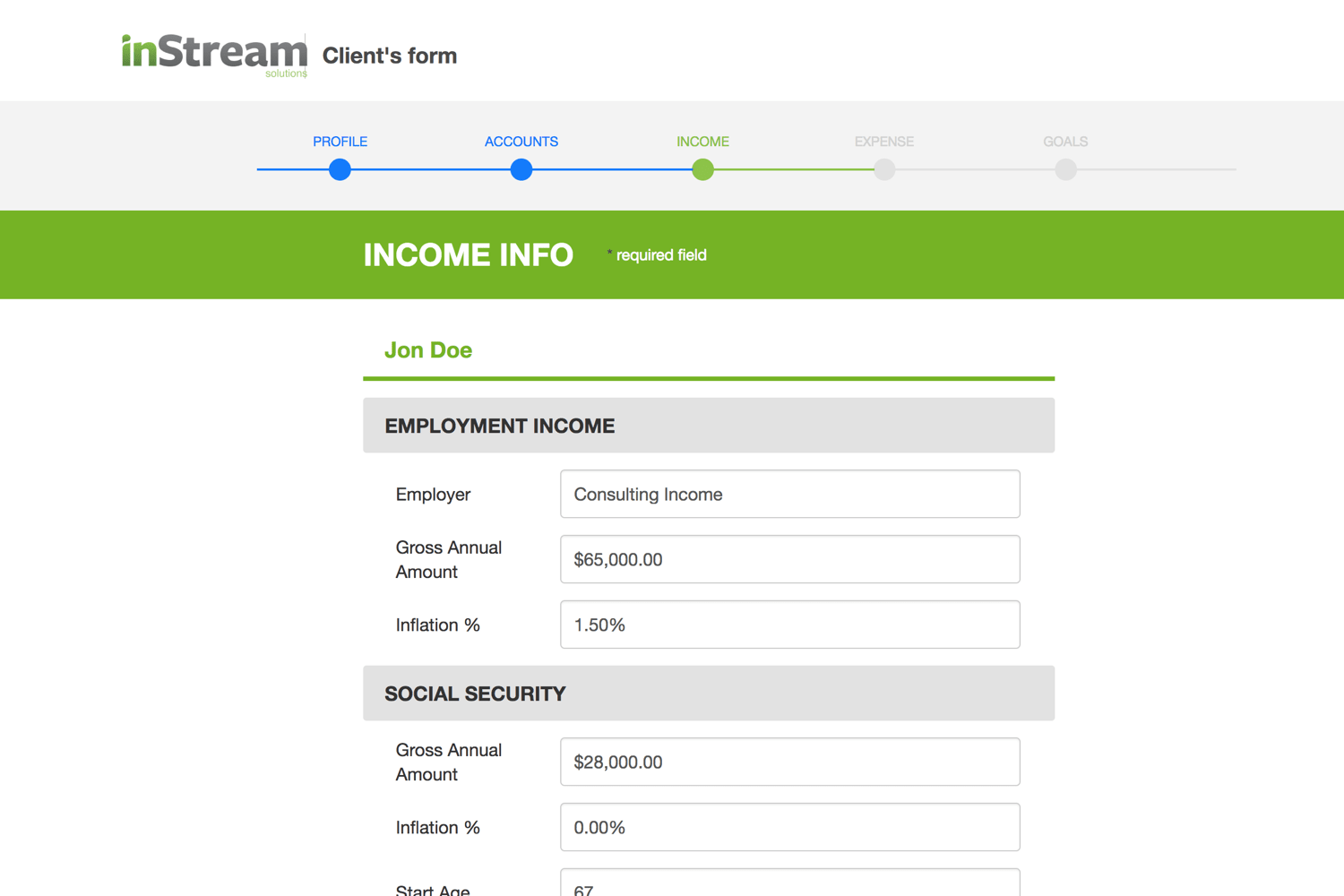

Scale efforts with Quick Analysis Fact Finder

Gather data through our intuitive fact finder. Spend less time inputting data, and inStream will even automatically generate the first quick analysis financial plan for you!

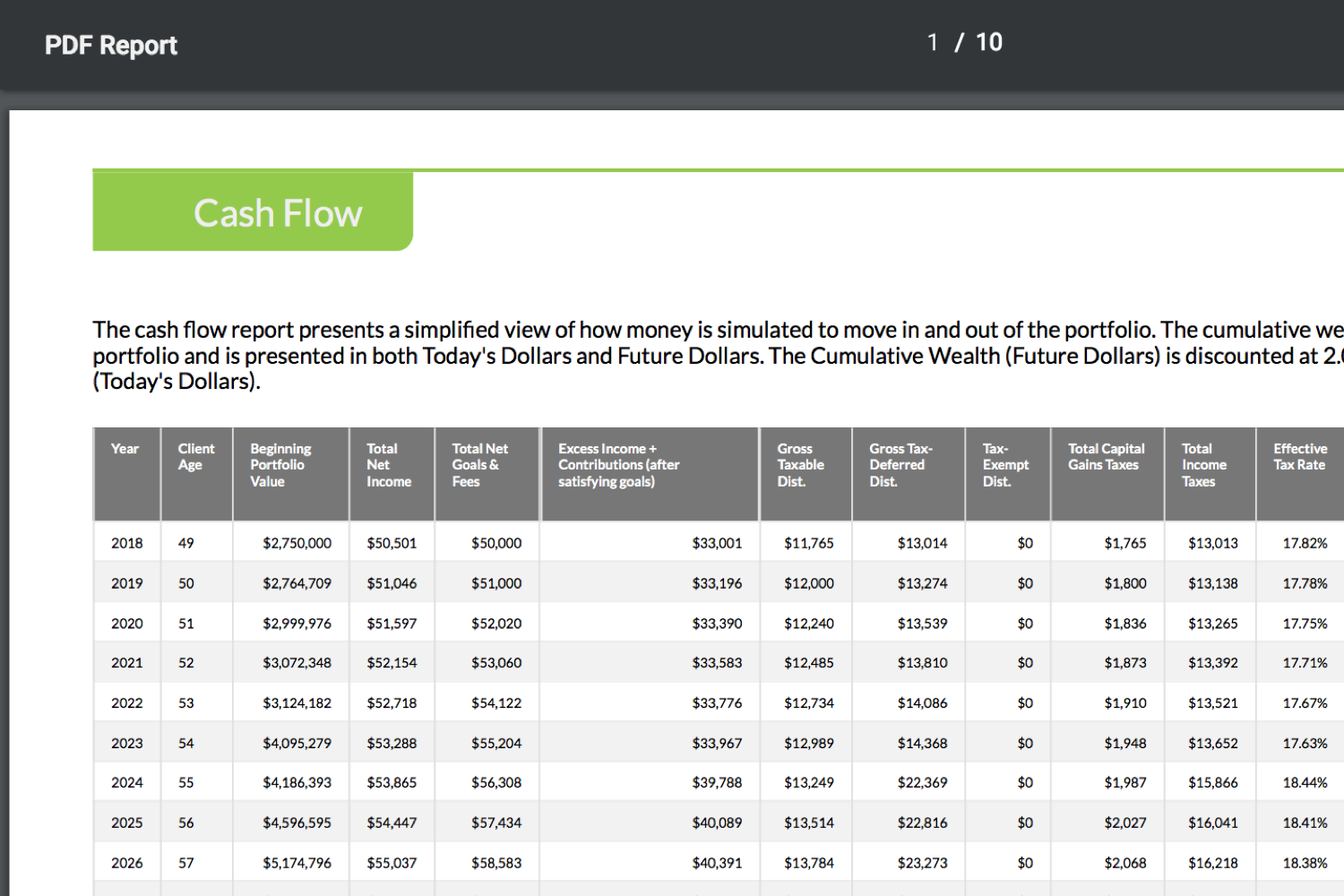

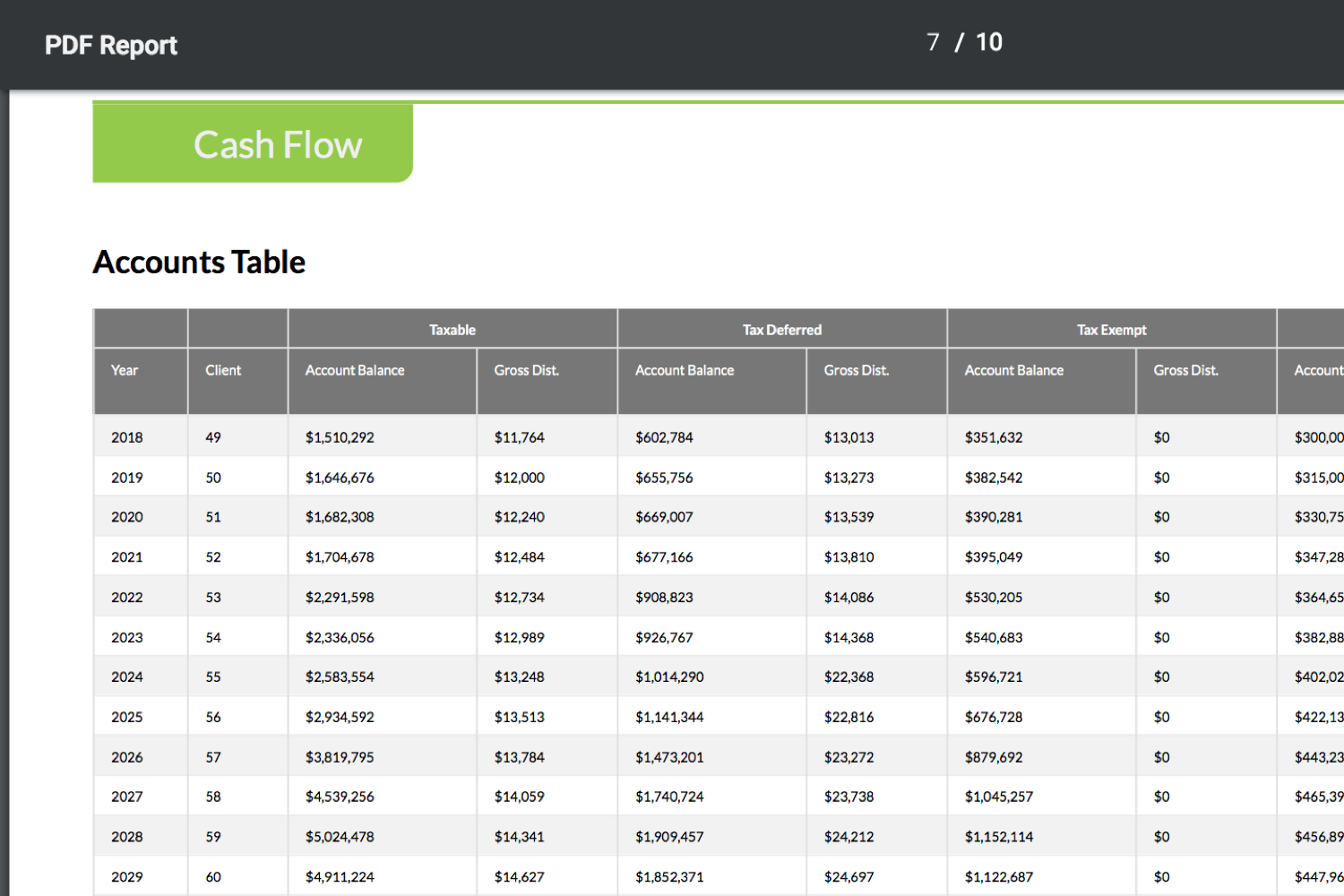

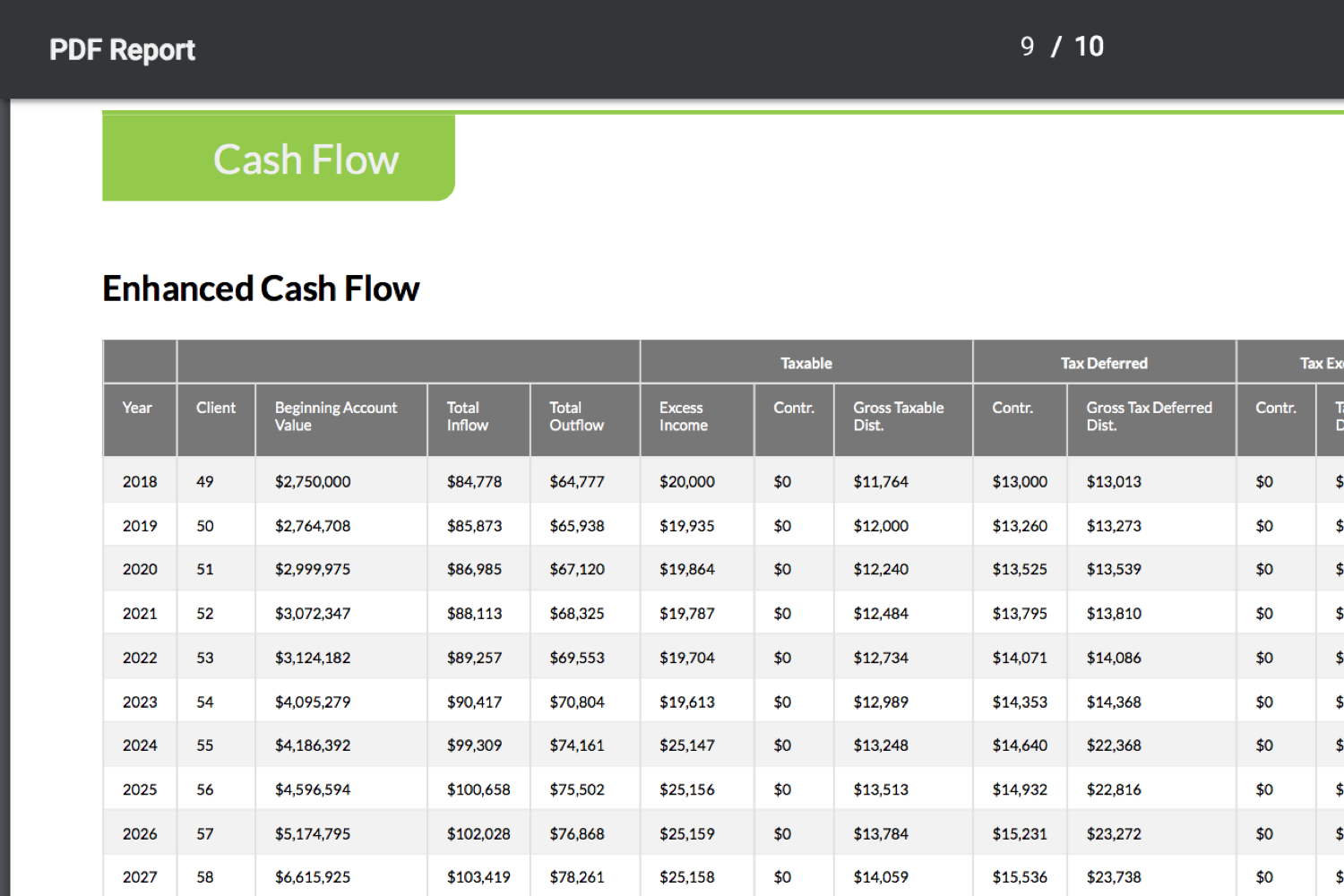

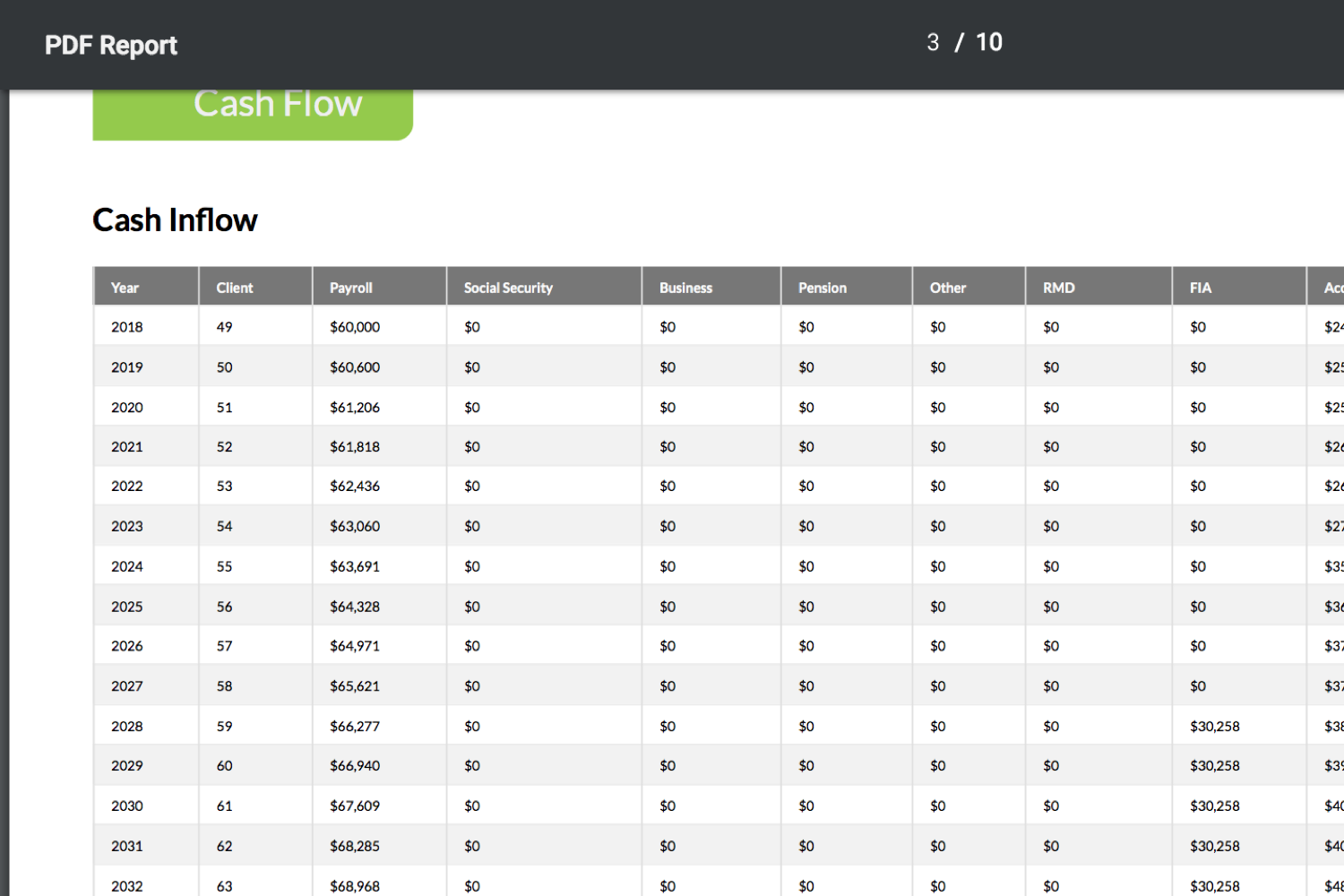

All About Cash Flow

Communicate easier with five cash flow reports

Our five cash flow reports go from detailed to overview and makes the plan easy to understand and even easier to communicate with your clients.

Integrations

Other Features

Our unique wealth management platform comes built with several key features that will help guide you guide your clients in an efficient, clear manner.

Generate custom reports for your clients for any of the data included in the plan.

Custom Branding

Customize fonts, colors, branding within the inStream platform and on any reports created.

Global Settings

Quickly and easily adjust settings firm-wise to establish consistency.

inStream Pricing

inStream is offered on monthly and yearly plans. Data aggregation is available at an additional cost. Discounts may also be available for multiple seat selections. Contact us for more details.